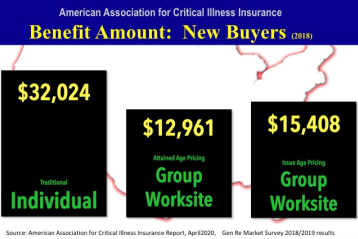

Benefit amounts vary for new critical illness insurance protection based on where purchased.*

“The typical individual would benefit from between $10,000 to $25,000 of coverage.”

Jesse Slome, director of the American Association of Critical Illness Insurance

Buyers vary in how much critical illness insurance they select

Buyers of critical illness insurance protection make different choices. Decisions depend on where they obtain coverage according to a report released by the American Association for Critical Illness Insurance.

“Buyers purchasing traditional individual coverage sold by insurance agents select higher coverage levels,” shares Jesse Slome, director of the American Association for Critical Illness Insurance (AACII). The average new benefit amount for traditional ci insurance was $32,024.

Most critical illness insurance is purchased through the workplace Slome acknowledged. “Coverage amounts here were much less, ranging from between $12,961 to $15,408,” he notes. The data comes from the 2018/2019 U.S. Critical Illness Insurance Market Survey conducted by Gen Re which analyzed different pricing models used.

“One can speculate why benefit amounts for traditional ci insurance are higher,” Slome commented. “In some cases, the product is being sold to small business owners or it simply could be because an agent is directly involved in the sale. My sense is that the smaller sales made through the worksite are a good indicator of what protection levels consumers believe are needed.”

Buyers with smaller benefit amounts can be sufficient suggests AACII director

Critical illness insurance benefit amounts are typically offered from as low as $5,000 to as much as $100,000. “Larger policies are rare,” Slome admits. “Frankly from the research we have conducted, the typical individual would benefit from between $10,000 to $25,000 of coverage.”

The Association recently released information on critical illness insurance buyers. “The average age for buyers was roughly 47, while buyers of group policies sold through the worksite averaged closer to 42”, Slome shares.

Tips for critical illness insurance planning

First of all, the Association recommends all men and women over 40 read more about what is critical illness insurance?

To see latest critical illness insurance statistics, click the highlighted link.

Thirdly, to learn more about employer critical illness insurance coverage, click the highlighted link..

Fourthly, read tips to better compare critical illness insurance coverage. Significantly there are differences between policies. Therefore the helpful tips can save you money.