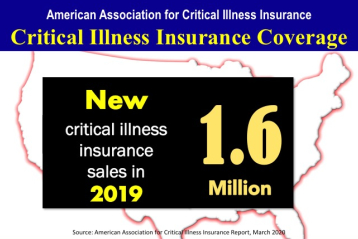

1.6 million new policies provide critical illness insurance protection for 2019.*

“The over one and a half million new certificates and policies is a significant number.”

Jesse Slome, director of the American Association of Critical Illness Insurance

New sales of critical illness insurance reported

Some 1.6 million Americans purchased critical illness insurance protection according to the American Association for Critical Illness Insurance (AACII).

“Most coverage is still purchased through the workplace but we see growth potential for individual policy sales,” reports Jesse Slome, AACII’s director. Currently five million Americans have some form of cancer-only or comprehensive critical illness insurance coverage according to the organization.

The latest report from the Association is part of the recently launched awareness campaign.

“The over one and a half million new certificates and policies is a significant number,” cites Slome. “At its peak, some 750,000 Americans purchased long-term care insurance, just to put this into perspective.” Slome also heads the American Association for Long-Term Care Insurance.

New sales growth expected by AACII director

The number of buyers does not surprise Slome. “Critical illness insurance is the ideal protection for the roughly 150 million GenXers and Millennials,” he explains. “These individuals clearly understand the risk they face. I am betting that most buyers know someone in their age group who has been diagnosed with cancer. They have seen the financial impact it takes.” Slome anticipates the number of new buyers will continue to grow in the current year. “It’s the right product for the right need and today’s younger buyers,” the AACII director adds.

The critical illness insurance expert notes that individuals who have health insurance often face significant health-related costs. “So many have high-deductible plans to which you add out-of-pocket costs,” Slome notes. “Health insurance premiums have to continue to be paid even while you receive care.” The Association recently released information on critical illness insurance buyers. “The average age for buyers was roughly 47, while buyers of group policies sold through the worksite averaged closer to 42”, Slome shares.

The Association recently released information on critical illness insurance buyers. “The average age for buyers was roughly 47, while buyers of group policies sold through the worksite averaged closer to 42”, Slome shares.

Tips for critical illness insurance planning

First of all, the Association recommends all men and women over 40 read more about what is critical illness insurance?

Secondly, use the Association’s instant critical illness insurance cost calculator to see an instant estimate of costs.

Thirdly, stroke is only one health risk. Indeed cancer is a significant risk especially at ages prior to 70.

Fourthly, read tips to better compare critical illness insurance coverage. Significantly there are differences between policies. Therefore the helpful tips can save you money.