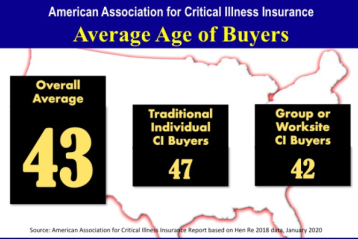

Average age of buyers for new critical illness insurance coverage is 43.*

“The ideal time to purchase critical illness insurance protection is between your mid-30s and 50s.”

Jesse Slome, director of the American Association of Critical Illness Insurance

Buyers of critical illness insurance – 2020 report

The average age of U.S. critical illness insurance buyers is 43 reports the American Association for Critical Illness Insurance (AACII). New business issue age varied based on whether the insurance is purchased on an individual basis or through an employer offering.

Five million Americans currently have some form of cancer-only or comprehensive critical illness insurance coverage according to the organization.

“The ideal time to purchase critical illness insurance protection is between your mid-30s and 50s,” reports Jesse Slome, AACII’s director. The latest data for buyers comes from the 2018/2019 U.S. Critical Illness Insurance Market Survey conducted by Gen Re.

Critical illness insurance pays a lump-sum amount upon diagnosis of a covered condition. “If you are diagnosed with cancer in your 40s, 50s or 60s, you are going to be treated. You will very likely survive,” Slome explains. “But your savings and any assets you accumulated will likely be impacted.”

Buyers of individual critical illness insurance policies are slightly older than those buying through the workplace according to the Gen Re study. “The average age for individual ci insurance buyers was roughly 47. Buyers of group policies sold through the worksite averaged closer to 42”, Slome shares.

Tips for critical illness insurance planning

First of all, the Association recommends all men and women over 40 read more about what is critical illness insurance?

Secondly, use the Association’s instant critical illness insurance cost calculator to see an instant estimate of costs.

Thirdly, stroke is only one health risk. Indeed cancer is a significant risk especially at ages prior to 70.

Fourthly, read tips to better compare critical illness insurance coverage. Significantly there are differences between policies. Therefore the helpful tips can save you money.

* AACII News Release, April 6, 2020

Equally important, here are additional tips for consumers.

Firstly, adults 55-65 should also learn more about long-term care insurance. Visit the American Association for Long-Term Care Insurance to learn more. Then request a free no obligation quote from a LTC insurance specialist.

Secondly, adults turning 65 can find Local Medicare Agents using the American Association for Medicare Supplement Insurance‘s free online lookup.

Thirdly, learn about stroke signs and symptoms. Specifically print them out if you believe you are at higher risk.

Fourthly, if you think someone is having a stroke, immediately call 911. Since immediate treatment improves the chances of surviving a stroke.

Finally, try to live a more healthy lifestyle. Undeniably it’s the most important thing you can do.