Employer Critical Illness Insurance

Are you an Employee or an Employer?

I'm an Employee

I'm an Employer

If your company offers critical illness insurance here are things to compare:

- Firstly is a cancer-only option available?

- Secondly compare the monthly or annual rate.

- Thirdly is there an added charge for paying monthly?

- Fourthly are there any additional fees?

- Do non-smokers pay the same as smokers?

- Similarly do men and women both pay the same?

- Are premiums level or will they increase as you age?

- If you leave the company, can you continue the coverage?

- Does the policy terminate at a certain age?

- Finally can your spouse or partner be covered by the same company?

Coming soon. Tips for employers shared by leading benefit consultants and industry experts who specialize in critical illness insurance.

Employer seeking plan comparisons. If you are an employer seeking comparisons of critical illness insurance offerings, please reach out to the Association.

Call Jesse Slome at 818-597-3205

Or, click the Contact Us link and send us a message.

Employee tips to get the best costs

Employer ci insurance: what companies offer?

Price is the first thing most people want to compare.

Price is the first thing most people want to compare.

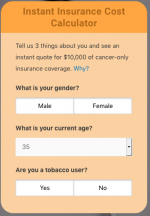

Use the Association’s Critical Illness Insurance Cost Calculator. You will get an instant estimated cost for $10,000 of cancer-only insurance.

Click the link or the image to access the calculator. No personal information is needed to get costs.

You can also get a cost comparison directly from the insurance company offering both cancer-only and comprehensive ci insurance. These options are exclusively offered via the Association’s website.

You can also get a cost comparison directly from the insurance company offering both cancer-only and comprehensive ci insurance. These options are exclusively offered via the Association’s website.

Click on the Get Your Free Quote banner now.

Employee tips to get the best coverage

Employer mistakes to avoid

Employee tips coming soon.

Employer mistakes to avoid coming soon.