Statistics 2020 for Critical Illness Insurance

Statistics 2020. Here are the top critical illness insurance statistics. Information provided by the American Association for Critical Illness Insurance.

- Current policies / certificates

- New Buyers (latest year)

- Buyers: Average age of buyers

- Claimants: Average age of claimants

- Types of Claims (by diagnosis)

- Benefit Amount (New business)

- Market Size (2018)

Latest update posted: April 21, 2020

Reporters, bloggers and writers seeking facts, data and information

Contact Jesse Slome if you would like additional information.

The American Association for Critical Illness Insurance advocates for the importance of planning.

Specifically all information on our website may be used. Credit the American Association for Critical Illness Insurance. Likewise, please include a link to our homepage where possible.

Additional pages where we have posted valuable statistics and data

Latest data regarding heart attack statistics in the U.S. Click this link.

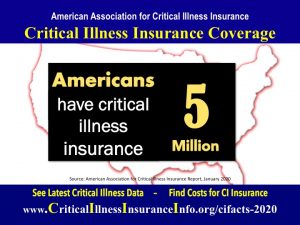

Statistics 2020: How many current CI policies or certificates?

There are five million Americans who have critical illness insurance coverage as of January 1, 2020.

The number has increased compared to prior years.

This data based on the American Association for Critical Illness Insurance 2020 report.

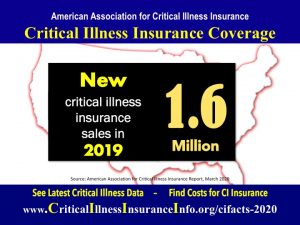

Statistics 2020: How many new certificates or policies were purchased?

Over one and a half million Americans purchased coverage last year.

Most purchase coverage through the worksite.

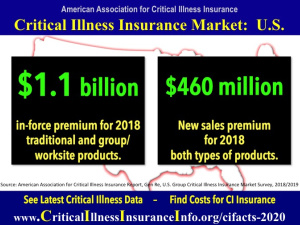

Market Size (Latest Data)

2018 new sales and in-force business as reported by Gen Re, U.S. Group Critical Illness Insurance Market Survey (2018/2019 results).

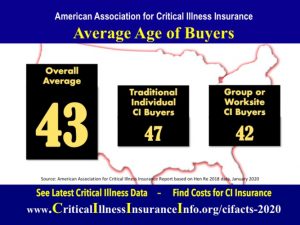

Statistics 2020: What is the average age of new critical illness insurance buyers?

The average age of U.S. critical illness insurance buyers is 43. The American Association for Critical Illness Insurance reported data on April 6, 2020.

- Average age for new buyer of traditional ci insurance: 46.6

- For Group / Worksite using attained age pricing: 41.5

- Group / Worksite using issue age: 41.9

Data shared by Gen Re’s 2018/2019 U.S. Critical Illness Insurance Market Survey.

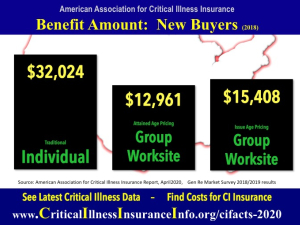

Statistics 2020: Benefit amounts purchased?

The average critical illness insurance new benefit amount varies. Traditional individual policies purchased through an insurance agent tend to be significantly larger.

Critical illness insurance policies purchased through the worksite are smaller. They ranged from $12,961 for policies using attained age pricing to $15,408 for policies using issue age pricing.

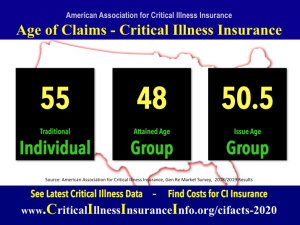

Statistics 2020: What is the average age for critical illness insurance claims?

At the time of claim, the average age of a traditional individual claimant was 55.1 years. For Group/Worksite attained age pricing, the average age was 47.8. For Group/Worksite issue age pricing the average claimant age was 50.5.

Data shared by Gen Re U.S. Critical Illness Insurance Market Survey, 2018/2019 results.

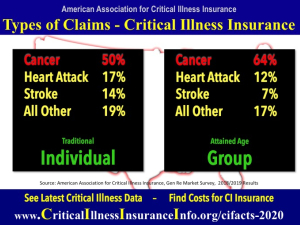

Statistics 2020: What is the reasons policyholders claim benefits?

Cancer is the reason for half (50%) of all claims; traditional individual policies. Cancer is the reason for nearly two-thirds (64%) of Group policies (attained age pricing).

Reasons for claims for Group (issue age pricing policies) are cancer (47%), heart attack (18%), stroke (8%) all other (27%).

Data shared by Gen Re U.S. Critical Illness Insurance Market Survey, 2018/2019 results.

Looking for specific critical illness insurance information. Call Jesse Slome at the Association 818-597-3205.

Additional Resources for Insurance Quotes

Here are links to our other insurance industry organizations.

For long-term care insurance quotes visit the American Association for Long-Term Care Insurance.

To find Medicare Insurance agents use the Medicare Insurance Agent directory offered by the American Association for Medicare Supplement Insurance.

Tips for finding the best critical illness insurance policy.

Obviously, compare costs and benefits.

If you are in your 40s significantly consider a cancer-only policy. Likewise, if you are in your 50s, compare a comprehensive ci policy. If you do not use tobacco products it is equally important to find a policy that offers non-smoker rates. Rates shown online may not be accurate because rates vary by State. If you have health conditions, certainly compare a policy that is guaranteed issue. If you have no health issues conversely compare a plan that asks health questions. It may save you money which unquestionably can be desirable. Finally always read your policy when it arrives. It explicitly contains all the information you need to know. Indeed that is the smartest move you can make.

New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better heart health in midlife lowers late-life dementia risk

Better cardiovascular health in midlife can reduce dementia risk later in life.

Insomnia heart disease; 42% reduction in heart failure

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

Instant Insurance Cost Calculator

An Exclusive Offer

Highly affordable cancer or critical illness insurance

from Unified Life Insurance Company

- Lump sum immediate cash benefits: $10,000 to $25,000

- Ages 30 to 55

- Rates starting as low as $3.25 per month