New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

If you are ever diagnosed with a serious illness, one of the last things you want to worry about is your finances.

If you are ever diagnosed with a serious illness, one of the last things you want to worry about is your finances.

A Critical Illness Insurance policy provides a lump-sum, cash payment if you are ever diagnosed with one of many covered conditions.

It can help you focus on getting well – instead of worrying about paying healthcare charges, your rent or mortgage, credit cards bills.

You and your family depend on your income. A small cancer or ci insurance policy can replace lost income when you take time off to undergo medical treatments. It can cover costs that your health insurance won’t pay. This is most-important coverage for self-employed, small business owners and gig economy workers who are in their 40s and 50s. Imagine the peace of mind 6 to 12 months worth of cash provides when you need it most!

You and your family depend on your income. A small cancer or ci insurance policy can replace lost income when you take time off to undergo medical treatments. It can cover costs that your health insurance won’t pay. This is most-important coverage for self-employed, small business owners and gig economy workers who are in their 40s and 50s. Imagine the peace of mind 6 to 12 months worth of cash provides when you need it most!

One illness can seriously disrupt your family’s finances. Imagine the value of a lump-sum payment to pay rent or mortgage payments while you undergo treatments and recover.

Health insurance deductibles and co-pays add up quickly. And with illnesses like cancer, so will drug costs. A lump-sum cash payment can mean all the difference in the world to you.

Today, your risk of a critical illness before retirement (at 65 or 70) is higher than the risk of dying. Life insurance is no longer your most essential risk.

Breast cancer is such a risk. Thankfully it’s survivable but having even a modest lump-sum cash payment for rent, mortgage, bills can be so valuable for women on their own.

PROTECTION FOR TODAY’S RISK & TODAY’S NEEDS. Even if you know someone who has been diagnosed with cancer, or someone who had a heart attack, it’s natural to think that serious illnesses only happen to other people.

However, the true picture is quite different. Today, women and men suffer from cancer (and heart issues) before they reach retirement age,

Life insurance companies make us think about what happens to our families if we die prematurely. But today, the risk of a critical illness before age 70 is significantly higher than the risk of dying.

A critical illness can have a devastating financial effect. For most people, a ‘modest‘ CI insurance policy will be sufficient and also affordable. It is protection for today’s risk and today’s needs.

Look for an insurer that gives you the option of cancer-only coverage. This may be the risk you worry about most. A cancer-only policy will be less costly than a comprehensive CI insurance policy.

Policy costs can vary significantly based on many factors. Some insurers charge men and women the same, even though their risks vary. Some charge smokers and non-smokers the same. For this reason alone, comparing costs can save you monry.

Most CI insurance benefits paid range from $15,000 to $25,000. We suggest buying coverage equal to between 6 and 12 months of rent or mortgage payments. This will give you time to undergo treatment and plan your future.

The vast majority of critical illness insurance is purchased by employees. Your employer offered coverage may be great, but it’s always worth comparing. Individual coverage today may offer more options for less cost.

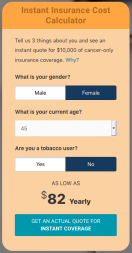

The Association’s Cost Calculator will show you an example of what $10,000 of cancer insurance can cost (2020 estimate).

The Association’s Cost Calculator will show you an example of what $10,000 of cancer insurance can cost (2020 estimate).

Simply click one button and a cost will appear.

Note this is simply an example based on coverage from a leading insurance company. We provide it to show that a modest amount of cancer-only coverage can be far less costly than you might think.

The American Association for Critical Illness Insurance is a national professional organization established to create heightened awareness among consumers. We also support insurance professionals who market these important forms of protection.

The American Association for Critical Illness Insurance is a national professional organization established to create heightened awareness among consumers. We also support insurance professionals who market these important forms of protection.

The following are some links to valuable pages containing relevant information.

Latest Cancer Facts, Statistics and Data.

Latest Heart Attack Facts, Statistics and Data.

Directory of Key Pages on this Website.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.