New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

This webpage contains relevant cancer and critical illness insurance data. This is important information for everyone between the ages of 35 and 55.

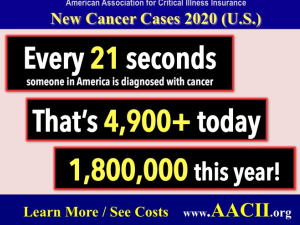

LATEST UPDATE: May 2020. The American Cancer Society now projects 1.8 million new cases. That is a new case every 21 seconds.

LATEST UPDATE: May 2020. The American Cancer Society now projects 1.8 million new cases. That is a new case every 21 seconds.

Access critical illness insurance statistics (2020). Click the link.

Read relevant heart attack statistics and data. Click the link.

For the latest stroke data and statistics, click here.

For women: Read breast cancer facts. Vital information for women between 40 and 55.

For 2020 more than 1.8 million new cancer cases are expected to be diagnosed this year. This does not include carcinoma in situ (noninvasive cancers).

For 2020 more than 1.8 million new cancer cases are expected to be diagnosed this year. This does not include carcinoma in situ (noninvasive cancers).

According to the American Cancer Society about 740,000 cases are avoidable. That includes the 19% of all cancers caused by smoking.

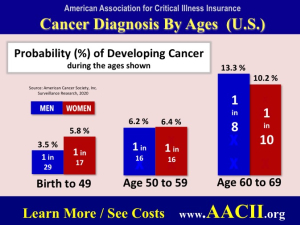

The median age of a cancer diagnosis is 66. Half of cancer cases occur in people younger than 66.

One-quarter of new cancer cases are diagnosed in people aged 65 to 74.

Cancer can occur at any age. For example, bone cancer is most frequently diagnosed among people under age 20. More than one-fourth of cases occur in this age group.

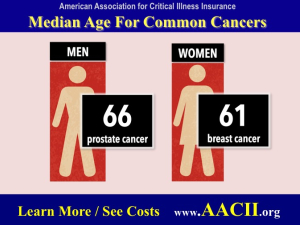

The median age at diagnosis is 61 years for breast cancer, 68 years for colorectal cancer, 70 years for lung cancer, and 66 years for prostate cancer.

Resource: National Cancer Institute

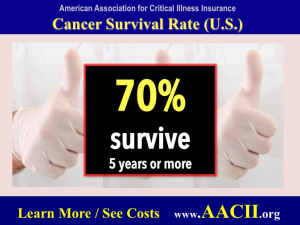

The 5-year relative survival rate for all cancers combined has increased substantially. In the early 1960s the survival rate was 39%.

Today the cancer survival rate is 70% among white adults and 63% among black adults. The survival rate varies greatly by cancer type as well as stage and age at diagnosis.

More details: American Cancer Society, Cancer Facts & Figures 2019

Cancer is the #1 reason for claims made by individuals with critical illness insurance.

It accounts for between 50 and 64 percent of claims. This valuable protection pays a lump-sum cash payment. The monies are paid directly to the policyholder. They can be used to cover any costs you face.

You may also choose to get a cancer-only insurance policy. That can save you money on valuable protection.

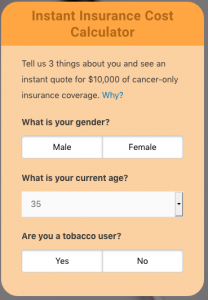

Use the Cost Calculator on this page to get a good estimate of costs for $10,000 of cancer-only insurance.

Use the Cost Calculator on this page to get a good estimate of costs for $10,000 of cancer-only insurance.

No personal information is required to see costs. Simply start by clicking the Male or Female box. Costs will appear immediately.

If you are interested, you can get an instant cost quote for BOTH cancer only and comprehensive critical illness insurance. Costs will be provided directly from an insurance company.

Because the risk of cancer after age 35 is real, it is important to know a few more facts.

Firstly, even the best health insurance today doesn’t cover everything.

Specifically you likely will pay high deductibles and face co-pays that can cost you thousands.

Additionally after a cancer diagnosis you will likely need to take time off from work for treatments. Plus time to recover.

Subsequently you’ll have no income to cover the bills that will keep piling up.

Following a cancer diagnosis you need to focus on recovering. You don’t need the added stress that comes from worrying about bills.

Specifically that’s where critical illness insurance comes in. Indeed a lump sum of cash can go a long way to covering some of those bills.

Also compare costs for a cancer-only insurance coverage. The savings can be substantial.

Finally, critical illness insurance can be far more affordable than you think. Especially if you price just a modest amount, generally between $10,000 and $25,000.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.