New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

This webpage contains relevant stroke and critical illness insurance data. This is important information for everyone between the ages of 45 and 60.

Access critical illness insurance statistics (2020). Click the link.

Read relevant heart attack statistics and data. Click the link.

For the latest cancer data and statistics, click here.

Approximately 800,000 primary (first-time) or secondary (recurrent) strokes occur each year in the U.S. The majority are primary strokes (roughly 600,000).

Stroke was a leading cause of serious long-term disability in the US. Approximately 3% of males and 2% of females reported that they were disabled because of stroke. Source: American Heart Association Fact Sheet 2019.

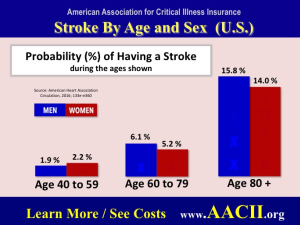

The incidence of stroke rapidly increases with age, doubling for each decade after age 55. From Stroke Epidemiology: Advancing Our Understanding of Disease Mechanism and Therapy

Learn more about stroke and critical illness planning. Visit the Association’s video page.

The risk increases with age, the incidence doubling with each decade after the age of 45 years and over 70% of all strokes occur above the age of 65.

Risk of having a first stroke is nearly twice as high for blacks as for whites. Source.

Stroke victims are getting younger. A study in England found that The figures show that 38% of people suffering strokes are middle aged (40-69). That is up from 33% a decade ago.

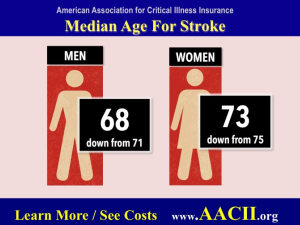

Few studies report the average age in the U.S. One reports the mean age for a stroke significantly decreased from 71.2 years in 1993/1994 to 69.2 years in 2005.

The average age for a woman suffering a stroke has dropped from 75 to 73. For men it has dropped from 71 to 68. That’s according to the Public Health English study.

Source for U.S. data: Neurology. Oct. 23, 2012

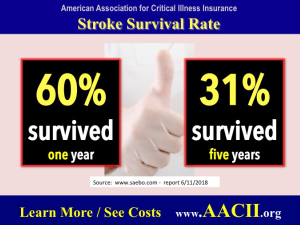

Medical treatment has become much more advanced. As a result, surviving a stroke is more likely each year.

Stroke severity and patient age are the two most important factors in predicting one’s chances of survival after a stroke.

One of the best studies found that of the surviving patients, 60 percent who suffered an ischemic stroke and 38 percent with intracerebral hemorrhage survived one year. Some 31 percent survived five years. The study found that those 50 or younger had a higher survival rate .

If you are in your 30s or 40s, you may do well with just a cancer-only insurance policy.

After age 50, strokes and heart attacks grow in their risk to you. According to the most recent data, strokes are the third-leading case for critical illness insurance claims.

You can get a quote for critical illness insurance directly from an insurance company.

Click on the advertisement found on this webpage. Or go back to our home page and click on the ad.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.