New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

The following are breast cancer facts for women who are between ages 40 and 60.

You are reading this because you realize the risk of a breast cancer diagnosis is real.

What you may not know is the importance of being financially prepared for this risk.

The American Cancer Society does extensive research regarding breast cancer. Women in their 20s and 30s have some risk. But it is minimal. One in 1,479 women in their 20s face a risk of being diagnosed within the next 10 years.

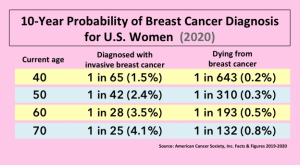

When you reach 40, the risk starts to grow. This chart shows the 10-year probability of breast cancer. At age 50, one in 42 women will be diagnosed with breast cancer before they turn 60.

When you reach 40, the risk starts to grow. This chart shows the 10-year probability of breast cancer. At age 50, one in 42 women will be diagnosed with breast cancer before they turn 60.

At age 60, one in 28 women will be diagnosed before they turn 70.

Breast cancer today is treatable. And, as the chart shows, the odds of dying are small when you are in your 50s, 60 and even 70s.

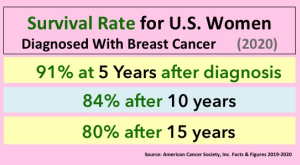

Most women who are diagnosed with breast cancer are treated and survive. The news gets even better because the data we show here is old. It is based on women diagnosed 10 or 15 years ago.

Most women who are diagnosed with breast cancer are treated and survive. The news gets even better because the data we show here is old. It is based on women diagnosed 10 or 15 years ago.

Constant improvements in treatments mean more women are likely to survive. That’s really good news.

Most women with early-stage breast cancer will have some type of surgery. Surgery is often combined with other treatments such as radiation therapy, chemotherapy, hormone therapy, and/or targeted therapy to reduce the risk of recurrence.

COSTS AND WHAT’S COVERED BY YOUR INSURANCE?

If you have health insurance, will it cover all costs? What about your health insurance plan’s deductible and co-payments?

If treatment covers more than one year, will you need to meet the deductible each year?

Breast cancer is a costly disease. The average costs per patient allowed by an insurance company in the year after diagnosis were between $60,637 and $134,682 (depending on the stage). This according to the National Institutes of Health.

The average costs allowed per patient in the 24 months after the index diagnosis were between $71,909 and $182,655.

The risk of breast cancer is high and increases as you age. Even with good health insurance, you will likely face bills for care, medicines, travel to and from treatments. And, you will likely need to take time off from work.

Women in their 40s and 50s should consider the importance of having a modest cancer-insurance plan in place. This policy will pay an immediate lump-sum cash payment directly to you following a diagnosis. You can find policies that will pay you $10,000 or more.

How much should you consider? Some protection is always better than none.

The American Association for Critical Illness insurance recommends the following formula. Calculate your rent or mortgage payments for 6 to 18 months. Price insurance to cover 6 months. Then price insurance that will cover 18 months.

Buy the amount you can best afford today. You can always buy additional coverage down the road.

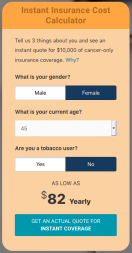

Use the Cost Calculator on this website to get an instant estimate of what $10,000 of cancer insurance costs for a woman.

Use the Cost Calculator on this website to get an instant estimate of what $10,000 of cancer insurance costs for a woman.

A 45-year old woman can expect to pay around $82 a year for a cancer insurance policy that pays $10,000 of benefits. This is the rate for non-tobacco users. A smoker will pay more. The calculator will show $108 for a 45-year old female tobacco users.

Should smokers buy cancer insurance? Absolutely! You may pay more because your risk is so much higher. But the coverage is so essential.

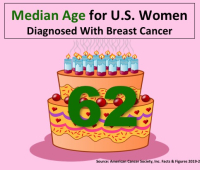

The median age at the time of breast cancer diagnosis was 62. That was a study of diagnosis between 2012 and 2016.

The median age at the time of breast cancer diagnosis was 62. That was a study of diagnosis between 2012 and 2016.

That means half of the women who developed breast cancer were age 62 or younger.

Cance insurance (or critical illness insurance) is only available to women who apply before they are diagnosed with any cancer issue. Since the risk really starts around age 40 and grows from there, we strongly suggest looking into this before your 55th birthday. The earlier the better. And probably the less you’ll pay.

If your company offers an employer critical illness insurance coverage plan, read our tips before buying.

Critical illness insurance policies also provide benefits for cancer. They tend to cost more for the added coverage. Learn more about critical illness insurance statistics to help you make an informed decision.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.