New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

It’s smart to ask ‘why get critical illness insurance‘. The short answer is because the risk is real. Most likely you’ll survive. But the financial consequences can be severe.

It’s smart to ask ‘why get critical illness insurance‘. The short answer is because the risk is real. Most likely you’ll survive. But the financial consequences can be severe.

People buy cancer insurance or critical illness insurance so they will get cash to pay costs not covered by their health insurance. They’ll need that money to pay bills while they take time away from work for treatment or recovery.

We all hope it never happens to us. But hope is not a plan.

Critical illnesses happen to millions of Americans every year. On this webpage we share some of the most relevant data, information and links to information.

Our goal is to help you realize the importance of planning. Doing something about the risk is completely up to you. This website is a great place to start. Learn more today about critical illness insurance costs, planning and ways to save.

Why? Because 1.8 million Americans will be diagnosed with cancer this year.

And, every 40 seconds one American will have a heart attack. Every 40 seconds someone else will have a stroke.

Critical illnesses happen every day. To people young and old alike. They happen to people who have planned … and to people who have not. Those who planned are in a better position. That’s why!

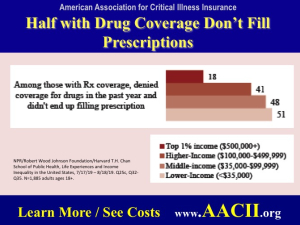

If you have a critical illness, you are going to be taking many drugs. And, you will likely be shocked to learn that your health insurance doesn’t cover them all.

If you have a critical illness, you are going to be taking many drugs. And, you will likely be shocked to learn that your health insurance doesn’t cover them all.

In fact, a 2020 study showed that when drugs are not covered by health insurance, half don’t fill the prescription.

If they had a small critical illness policy, they would have cash available to pay for the drugs that would help them recover faster and better. That’s why!

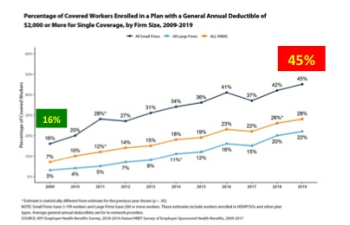

Currently 82 percent of covered workers have a general annual health insurance plan deductible. This amount must be met before most services are paid for.

Currently 82 percent of covered workers have a general annual health insurance plan deductible. This amount must be met before most services are paid for.

The average deductible for covered workers is higher in small firms than large firms ($2,271 vs. $1,412). The average annual deductible among covered workers with a deductible has increased 36% over the last five years.

Over the past 10 years, the percentage of covered workers at small companies with a general annual deductible of $2,000 or more for single coverage has grown from 16% to 45%. That’s why!

Learn more about heart attack risks for men and women. See ages when attacks occur, survival rate and more.

See cancer risk data; ages for diagnosis, survival rate.

Stroke risks and data; ages when strokes occur, survival rates and claims info.

2020 critical illness insurance data. Policies, in-force, buyers and claims.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.