New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

What does cancer insurance cover?

What does cancer insurance cover?

How does it differ from critical illness insurance? Which one is better for you?

Where can I find best costs?

What should you look for when buying this protection?

Can I get both cancer and critical illness insurance coverage?

This insurance specifically pays a cash benefit upon the diagnosis of cancer. That is undoubtedly the obvious answer.

It is important to realize that cancer insurance policies can each be different. Firstly they can have different definitions. Also different benefit amounts. That is to say, 100% of the benefit amount for some cancers and 25% of the benefit amount for others. Likewise they may have exclusions such as common skin cancers.

Secondly policies can have different termination dates. Unquestionably you want a policy that cannot be terminated prior to retirement age (generally 65 to 70). Alternatively you may want coverage that extends to older ages. Because the risk of cancer increases at these older ages you should expect to pay significantly more for this.

Learn more about cancer insurance. Read tips on what to look for. See how to compare cancer insurance policies.

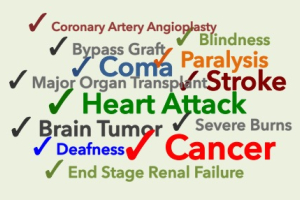

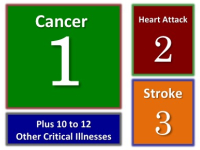

A critical illness insurance policy generally covers multiple illnesses. Undoubtedly cancer, heart attack and stroke are covered. Additionally, policies pay benefits for generally between eight and 12 additional conditions.

A critical illness insurance policy generally covers multiple illnesses. Undoubtedly cancer, heart attack and stroke are covered. Additionally, policies pay benefits for generally between eight and 12 additional conditions.

Because more possible conditions are covered, critical illness insurance policies cost more than a cancer-only policy. Some companies offer one policy with two options. Alternatively two separate policies might be offered.

See more about critical illness insurance quotes.

First of all this is a personal decision based on your needs and your financial situation.

You will pay less for a cancer-only insurance policy. Typically it costs about one-third as much.

Secondly your age is a factor. Cancer tends to happen at younger ages. So, if you are in your 40s, cancer generally is the bigger risk you face.

But undoubtedly both pose very real financial risks to you and your family.

Find an insurance company that offers both options within one policy. Get prices for both options. That information will help you decide which is best for you.

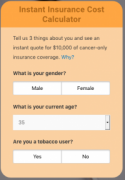

Use the Cost Calculator on the Association’s website to see rough cancer insurance costs.

Use the Cost Calculator on the Association’s website to see rough cancer insurance costs.

Click on one of the gender buttons. The calculator will immediately show rate for $10,000 of coverage. The average critical illness insurance policy ranges from about $15,000 to $30,000. Get actual costs directly from an insurance company. Some now offer online applications that give you a price before buying.

Look for a cancer insurance policy that provides coverage at least until you reach age 65 or 70. After that age you may have Social Security and pension income. You may also have Medicare coverage that eliminates your risk of paying deductible and co-pay expenses.

If you are considering an employer critical illness insurance plan, read our suggestions of what to compare.

You can. Undoubtedly this can be a smart strategy. Use it to get the coverage you most need based on your age. It can also save you money.

Buy a small cancer-only policy in your 40s. This is an especially smart strategy for women because of the added risk of breast cancer.

Add a small critical illness insurance policy. But it at the same time or buy it later (say when you turn 49). You can keep both. Or you can drop the cancer only. Your ci policy will cover a cancer diagnosis.

Discover ways to save on Medicare Supplement insurance. Find local Medicare insurance agents using the free Zip Code directory provided by the American Association for Medicare Supplement Insurance.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.