New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

A Message from Jesse Slome, Director of the American Association for Critical Insurance

A Message from Jesse Slome, Director of the American Association for Critical Insurance

Critical illness insurance was conceived of by a world-renown heart surgeon. Therefore the first policies available in the 1980s covered heart attacks and heart transplants.

Cancer insurance was also available at the time. It was typically sold as a completely separate policy.

Having both options combined into one offering gives consumers greater choice. It also gives added options. Therefore many insurers recognize this.

While the industry category is referred to as “critical illness”. Today cancer is the main critical illness most people worry about. Significantly when the Association looked for a product to make available. We specifically required a product that would offer both options. Option one is a cancer-insurance only benefit. Option two is a comprehensive ci benefit.

Thank you for taking the time to visit the Association’s website.

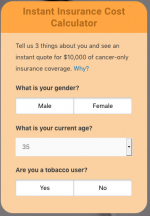

A Cost Calculator can be found on this webpage. Use it to instantly show costs for $10,000 of cancer insurance coverage.

A Cost Calculator can be found on this webpage. Use it to instantly show costs for $10,000 of cancer insurance coverage.

You will see a cost immediately without entering any personal information.

To start simply click either the Male or Female box.

The costs shown are generally based on the Exclusive Offer from Unified Life Insurance Company.

![]() You can click the FREE QUOTE box on the advertisement found on this webpage. When you do, an instant cost quote for BOTH cancer insurance and critical illness insurance can be found.

You can click the FREE QUOTE box on the advertisement found on this webpage. When you do, an instant cost quote for BOTH cancer insurance and critical illness insurance can be found.

You probably worry more about cancer than a heart attack or stroke. That is understandable and common if you are in your 40s or young 50s.

Over 1.8 million Americans will be diagnosed with cancer in 2020.

In 2020, some 276,480 new cases of invasive breast cancer will be diagnosed in women.

Many cancers are diagnosed between ages 40 and 70.

Here is the probability of developing invasive cancer during selected ages:

Undoubtedly, your risk of cancer is highest after age 70. Because your risk is highest, your cost for insurance will also be higher.

Often at older ages our financial status has changed. You will have Social Security benefits. Secondly you may have 401(k) and retirement savings. You may no longer make mortgage payments.

Cancer insurance benefits may be most helpful during your working years. Thus, the Association recommends considering coverage that ends after you generally reach age 70.

Access the latest cancer statistics from the American Cancer Society.

Read health tips and summaries of the latest cancer health research findings.

Learn more about long-term care insurance, find long-term care insurance costs. Visit the American Association for Long-Term Care Insurance website.

Get best Medicare insurance information from local Medicare insurance agents. Use the American Association for Medicare Supplement Insurance’s free online national directory.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.