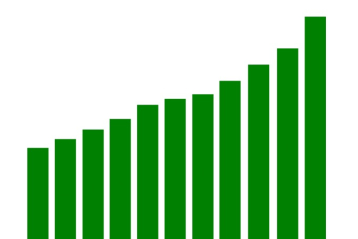

Sales of critical illness insurance will increase significantly expects industry expert.

Every product goes through cycles and critical illness insurance is poised to see significant growth over the next years.

Jesse Slome, director of the American Association of Critical Illness Insurance

Double digit sales growth is reasonable

All signs point to a significant increase sales growth for critical illness insurance. The outlook was shared today by Jesse Slome, director of the American Association for Critical Illness Insurance.

Here are reasons Slome expects sales growth:

- the average age for first home purchase is 33

- there are 88 million Gen Xers who are currently between age 40 and 54

- plus, there are 71 million Millennials in their 20s and 30s

- increased focus on product from insurers already selling products

- new insurers entering the critical illness marketplace

- improved ease of selling this product via online channels

“Every product goes through cycles and critical illness insurance is poised to see significant growth over the next years,” says Jesse Slome. The Association director discussed plans with senior executives of several insurers.

“There are millions of Americans who are now more aware than ever of what happens if their health changes,” Slome shared. “Everyone is currently focused on the Coronavirus but that will not be forever. Life will resume and people will be buying homes. I expect nothing less than double digit sales growth for critical illness insurance.”

Slome believes critical illness insurance needs to be more closely associated with mortgage protection. “Because a cancer diagnosis is no longer a death sentence, focus needs to be placed on this as mortgage interruption protection,” Slome notes. “Having a lump sum of cash to cover six to 18 months while you recover or look for new work becomes invaluable.”

Changing critical illness insurance messaging in the U.S.

The organization that Slome helped establish in 2009 is being relaunched. “We are going to be part of the reason there will be more awareness,” he predicts. “Awareness is the first step. It leads to greater sales. Messaging needs to be changed to link the product to the real risks and needs of Gen Xers and Millennials.”

Roughly five million Americans currently have some form of cancer only or comprehensive critical illness insurance protection according to the organization. “I don’t expect double digit growth in 2020,” Slome admits. “This is not going to be a normal year for anyone. But there is every reason to expect the growth I am predicting following the Coronavirus recovery.”

A cancer-only insurance policies provide a lump sum cash payment immediately following a cancer diagnosis. The comprehensive ci protection also pays benefits following a heart attack or stroke as well as other conditions. The Association posts tips that explain important ways to compare and get the best critical illness insurance quotes.

The American Association for Critical Illness Insurance was established in 2009. Based in Westlake Village, CA, the organization advocates for the importance of planning and supports insurance professionals who market these products. Jesse Slome is director as well as director of the American Association for Long-Term Care Insurance as well as the American Association for Medicare Supplement Insurance.

More reading on critical illness insurance.

Firstly, read What is Critical Illness Insurance?

Secondly, insurance agents, sign up to learn more about Selling CI Insurance.

Thirdly, Access the Critical Illness News Archive here.

Fourthly, contact Jesse Slome at the Association for more information.