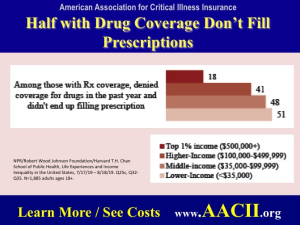

Nearly half do not fill prescriptions when their health insurance plan doesn’t pay.*

“Today you need something to cover the gaps in your health insurance like drugs, deductibles and co-pays,”

Jesse Slome, director of the American Association of Critical Illness Insurance

When drugs not covered people do not fill their prescriptions new study finds

Drugs not covered even for those with health insurance a new study finds. The result? Nearly half of Americans earning between $35,000 and $100,000 did not fill a prescription when it was declined by their insurance plan.

“Not all drugs prescribed by doctors are covered and when they are not people have two choices, pay themselves or forgo taking the medication,” explains Jesse Slome, director of the American Association for Critical Illness Insurance. “That forces tough choices particularly for lower and middle income Americans.”

Slome shared data from a poll conducted by the Harvard T.H. Chan School of Public Health. The study found that 48 percent of middle-income adults who were denied coverage for a prescription drug ultimately didn’t fill the prescription. Among lower-income adults the percentage was 48 percent. Lower income was defined as households earning $35,000 a year or less.

“Even good health insurance plans gave gaps in coverage something few people think about until they get a rude awakening,” Slome adds. ”This can be especially true when one is diagnosed with a critical illness such as cancer, when one has a heart attack or stroke or needs something significant like an organ transplant.”

Drugs not covered? Consider supplemental critical illness insurance

The critical illness insurance expert advocates plans that he identifies as ‘critical illness supplemental insurance’. “Today you need something to cover the gaps in your health insurance like drugs, deductibles and co-pays,” Slome explains. “For a relatively few dollars a month, these plans can be all the difference between getting the care you need as well as the ability to focus on recovery time.”

A plan that would provide a $10,000 cash benefit upon a cancer diagnosis could cost a 40-year-old man as little as $30-a-year. A 45-year old woman would pay about $85 a year for equal coverage. Both will likely pay more if you use tobacco products.”

Cancer patients are two and a half times as likely to declare bankruptcy as healthy people. Researchers have found that those patients who go bankrupt are 80 percent more likely to die from the disease than other cancer patients. This data comes from studies conducted by the Fred Hutchinson Cancer Center in Seattle.

Get instant costs for cancer insurance coverage

To learn more visit the Association’s website. Their critical illness cost calculator gives an instant estimate for plan costs.

The American Association for Critical Illness Insurance advocates for the importance of planning and supports insurance professionals who market these products.

Individuals are invited to use the Association’s instant critical illness insurance cost calculator. The calculator provides an instant estimate of costs for $10,000 of cancer insurance coverage. Offered employer critical illness insurance at work? Read more about comparing plans before signing up.

How much critical illness insurance do I need? Slome recommends the following; consider a plan equal to your rent or mortgage payment for between 6 and 18 months. That generally will be a suitable benefit amount to cover prescription drugs, your deductible and co-pays. Plus you’ll need some to cover bills while you recover and undergo treatments. A policy that provides between $10,000 and $25,000 of benefits will be less costly than larger policies.

Other resources recommended by AACII.

The American Association for Long-Term Care Insurance is the national information center for LTC insurance information. Request a free no obligation long-term care insurance cost quote from a LTC insurance specialist.

Turning 65? Find Local Medicare insurance agents on the American Association for Medicare Supplement Insurance website.

Thirdly.

Finally, try to live a more healthy lifestyle. Undeniably it’s the most important thing you can do.