Critical Illness Insurance Cost Calculator: A valuable tool to use during Critical Illness Awareness Month – The risk of cancer grows as we age. And, if you are in your 40s, 50, or 60s you should be concerned. A cancer diagnosis can happen to anyone at any time.

The good news is that most people diagnosed with cancer will survive. We have modern medicine to thank for that. And, hopefully you have a good health insurance plan (because no doubt that helps).

The bad news is that no matter how good your health insurance coverage, there are likely going to be costs. They could be small. But as prior articles have shown, the cost of cancer treatments, co-payments, deductibles and time off from work can create enormous financial pressure for individuals and families.

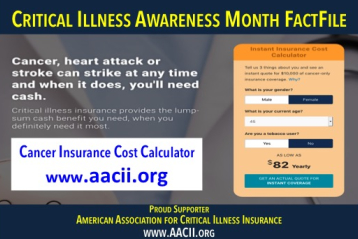

For that reason, the American Association for Critical Illness Insurance urges every man and woman over the age of 40 to take 30 seconds to use the critical illness insurance cost calculator. With two clicks, you’ll be shown an instant estimate of what $10,000 of cancer-only insurance costs. No personal information is needed to use the cost calculator and none of your personal information is accessed.

Cancer Insurance Is Protection Worth Considering

While our organization has the words critical illness in our name, we acknowledge that for many individuals in their 40s, 50s and 60s, cancer is both the larger risk. It’s the one you likely are more concerned about.

Critical illness insurance policies cover a multitude of conditions, cancer being one of the primary risks. But, today some insurance policies offer consumers the option of ‘cancer-only insurance’ as well as the more comprehensive critical illness coverage. The cancer only coverage will typically be significantly less expensive.

If you are offered coverage at work, look to see if the offering provides both options. If not, comparing your employer critical illness insurance offering could be well worth your time.

Find latest cancer facts, data and statistics to help learn more about your risk.