New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

If you are considering Metlife critical illness insurance, here are some reasons to compare.

Reason #1. You may be able to save.

#2. You may be able to get more coverage for the same cost.

And here’s #3 – #10. Re-read reasons #1 and #2. Saving money and better benefits.

There are about 60 different U.S. insurance companies that offer critical illness insurance policies. MetLife is one. Because each company sets their own price, the Association always encourages comparisons. We believe that an educated consumer is the best customer for this important protection.

There are about 60 different U.S. insurance companies that offer critical illness insurance policies. MetLife is one. Because each company sets their own price, the Association always encourages comparisons. We believe that an educated consumer is the best customer for this important protection.

By comparing you may indeed be able to save money. Significantly you may be able to get coverage that is more suitable for your needs.

Here are some things about critical illness insurance that many consumers don’t know.

Some critical illness insurance plans offer only one option for coverage.

Some critical illness insurance plans offer only one option for coverage.

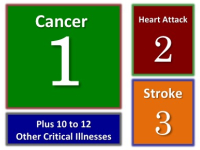

Your only option is a plan that pays benefits for various conditions. They typically include cancer, heart attack and strokes (the big 3).

Obviously an organization that has critical illness insurance in it’s name encourages you to protect against these real risks.

But we recognize that having options is a good thing. So is saving money.

Today, some insurance companies offer two choices (or options). They offer a cancer-only option.

Today, some insurance companies offer two choices (or options). They offer a cancer-only option.

There can be some significant reasons to consider this.

Firstly, you will save. A cancer-only plan generally costs about one-third as much.

Secondly, if you are younger, cancer may be the disease you most worry about. Indeed, heart attacks and strokes tend to occur at older ages (60s, 70s and older).

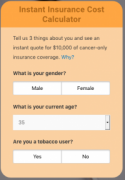

You can use the Cost Calculator to see a real estimate of what cancer-only insurance costs.

You can use the Cost Calculator to see a real estimate of what cancer-only insurance costs.

Just click any of the boxes. A dollar amount will immediately appear.

The calculator shows approximate costs for $10,000 of cancer-only coverage. You can also get a quote directly from an insurance company to help you compare.

Here are links to pages where we post some information that we believe is important.

Tips to compare employer critical illness insurance plans.

Read the latest and most relevant cancer statistics. What are average risks at various ages.

Finally, read heart attack statistics. See when the majority of people are at risk.

We are pleased to recommend the following resources for information.

Find Medicare Supplement information and statistics on the American Association for Medicare Supplement Insurance website.

Access the latest long-term care insurance information and statistics on the American Association for Long-Term Care Insurance’s website.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.