New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

The diagnosis of cancer or heart disease comes the reality of many medical bills + time off for treatments. You’ll need money for living expenses – rent or mortgage, car payments. You may have to pay health insurance deductibles and co-pays.

The diagnosis of cancer or heart disease comes the reality of many medical bills + time off for treatments. You’ll need money for living expenses – rent or mortgage, car payments. You may have to pay health insurance deductibles and co-pays.

Cancer Heart Attack Stroke Insurance helps provide the cash resources you need so you can FOCUS ON your treatment and recovery, NOT your finances.

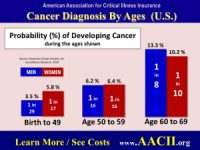

After age 40 women and men face a significant and increasing risk of cancer. We all hope it never happens to us. But it can and it does.

This year 1.8 million Americans will hear the dreaded words ‘you have cancer’. Most will be treated and the majority will survive.

What won’t survive is any savings they put away for their kids education or their retirement. Health insurance plans today often require that you pay a high deductible amount. Most health plans also require co-pays. Those costs can add up to thousands of dollars. And, not everything is covered when you have cancer.

Ouch. As if getting cancer wasn’t bad enough, you now face thousands of dollars of bills.

Plus you will probably take time off from work to undergo treatments and recover. If you are married your spouse may also take time off. That’s two reduced incomes just when you need money the most.

The Association recommends that cancer insurance coverage equal between 6 and 18 months of rent or mortgage payments.

The Association recommends that cancer insurance coverage equal between 6 and 18 months of rent or mortgage payments.

That generally will be enough to replace lost income and to cover those uncovered medical bills. There might even be a little bit left over. After surviving cancer, you deserve to treat yourself and your family to a little celebratory trip.

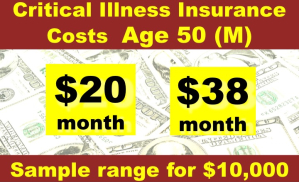

Cancer insurance policies typically start with benefits as low as $10,000. Most people buy between $10,000 and $30,000 of coverage.

Use the Cost Calculator on this webpage to get an instant idea of what $10,000 of cancer insurance costs.

Critical illness insurance is also known as cancer heart attack stroke insurance. Because it covers the Big 3 illnesses. Generally it also pays benefits for a number of other critical illnesses.

Critical illness insurance is also known as cancer heart attack stroke insurance. Because it covers the Big 3 illnesses. Generally it also pays benefits for a number of other critical illnesses.

Because this insurance pays benefits for many more conditions, the costs will be higher. Smokers or tobacco users will pay more. That’s because they face a significantly higher risk of disease.

Some insurance companies today will provide online rates for coverage.

Read more about cancer insurance. What to look for in a policy. How to find and compare cancer insurance policies.

See the latest critical illness insurance statistics. When do people buy insurance? How much coverage do they purchase?

The Association posts the most relevant cancer heart attack stroke insurance data. Best single source of relevant information.

Because we run two other insurance information centers here are pertinent links for consumers and insurance agents.

Turning 65? Find local Medicare insurance agents near me using the Medigap Association’s online free directory.

Own long-term care insurance. Read information regarding tax deductible long-term care insurance posted by AALTCI.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.