New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Aflac

AflacNearly half of workers ages 40 to 50 fear the financial consequences of a critical illness. Just 29 percent fear dying as their biggest concern.

It’s right to be concerned. The chances of being diagnosed (especially with cancer) before retirement is far higher than the risk of dying.

Millions of working age Americans are one diagnosis away from financial ruin.

Protecting yourself and your family with a small amount of critical illness (CI) insurance can be a smart financial move.

Keep reading to find out more about this type of coverage, And see why CI insurance is worth getting.

CI insurance is a type of supplemental insurance to your health insurance plan.

CI insurance is a type of supplemental insurance to your health insurance plan.

It helps fill in any potential gaps. For example, you plan may have a high deductible that you are responsible for. There may also be co-pays.

These policies pay you a lump-sum cash payment. Use it to pay your deductibles and co-pays. It can pay your rent or mortgage while you take time off from work for treatments or to recover.

Even the best medical health insurance plans today are usually not enough to cover the full costs of a critical illness.

The insurance company sends you one check to use any way you want. It’s not like health insurance plans where payments are tied to a particular expense.

You can use the cash to reduce the financial burden of your illness. It can pay for bills while you take time off from work for treatment or to recover.

Use your CI insurance payment for:

There are 60 different insurance companies that offer various policies. They can vary significantly. Costs can also vary.

There are 60 different insurance companies that offer various policies. They can vary significantly. Costs can also vary.

A good place to start is with the Association’s Cost Calculator. Use it to get an instant estimate of costs for $10,000 or cancer only insurance.

Read tips to compare critical illness policies. Find ways to get better coverage and save significantly on the cost.

For many working age adults, a policy that protects against the risk of cancer is a good place to start. The cost for $20,000 of cancer protection will be about 2x what the calculator shows.

Costs for critical illness insurance range. If $10,000 of cancer only coverage costs $100-a-year, you can figure that $10,000 of CI insurance will cost from $200 to $400 a year.

Coverage can be very affordable, as low as $10 a month. Many employers offer this coverage on a voluntary basis. Read tips for comparing group critical illness insurance policies.

Some insurers charge smokers and non-smokers the same. If you do not use tobacco products, you may save by finding a company that offers non-smoker discounts..

Most insurance companies offer between $10,000 and $50,000 of benefits. Some will offer much more. But you likely really only need a smaller policy.

Most insurance companies offer between $10,000 and $50,000 of benefits. Some will offer much more. But you likely really only need a smaller policy.

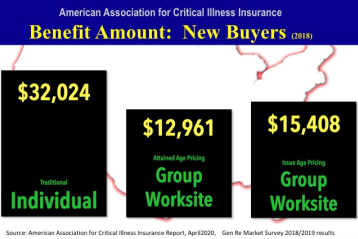

The average critical illness insurance policy purchased in 2020 was $12,961 (group or employer plan) and $32,024 (traditional individual).

No. Money received from a critical illness insurance payout is not considered to be income. Therefore they are received as a tax-free benefit.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.