New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

We’d like to share four important reasons why critical illness insurance planning can benefit you. Along with some planning tips.

We’d like to share four important reasons why critical illness insurance planning can benefit you. Along with some planning tips.

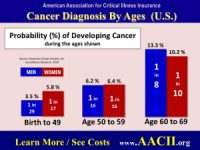

Actually, cancer planning is important in your 40s. That is especially true for women. Women tend to be diagnosed with cancer at younger ages because of breast cancer.

The risk of developing cancer before age 60 is high. You can find cancer diagnosis by age statistics here.

So while there is always a risk of having a heart attack or stroke, more people in their 40s are worried about cancer. You should be. Survival is likely but that comes with a huge financial cost.

For that reason we stress critical illness planning in your 40s should really focus on cancer planning. Where possible, look for a company that offers you both options combined within one product.

In your 50s, your 60s are no longer that far off. And, it’s in your 60s when you start to face a greater risk of a heart attack or stroke.

You can see heart attacks by age here. As you can see from the two charts, in your 50s, the risks start to balance.

For that reason we start to recommend that adults in their 50s look into a comprehensive ci policy. That’s one that covers all three critical illnesses – cancer, heart attack and stroke, Read our final planning tip for a suggestion we have never seen elsewhere.

Congratulations. You are one of those with health insurance. Not every American has coverage today.

But chances are you have a plan that includes a high deductible and likely co-pays.

A critical illness is going to ensure you have to pay that deductible amount which could be several thousand dollars. You are also going to face co-pays. Plus, not all treatments may be covered.

Most individual bankruptcies in the United States are the direct result of health issues. And, most of the people who file for bankruptcy had health insurance when the condition was first diagnosed.

Finally, don’t forget that while you are being treated you still have to pay your health insurance premiums. They are NOT waived while you get care. You must pay even if you are taking time off from work to recover.

For that reason, the Association recommends critical illness insurance benefits equal to between six (6) and 18 months of your rent or mortgage payments. That should cover loss of income while you recover. You can use it to also pay your health insurance deductibles, co-pays and monthly premiums.

We’ve explained that today better policies offer consumers options. One option is to buy cancer-only coverage. The other is a comprehensive critical illness insurance policy.

And, we’ve explained that at younger ages, the risk of cancer is greater than the risk of a heart attack or stroke.

The strategy we propose is buying two smaller plans of coverage instead of one larger plan. For example, in your 40s buy a smaller cancer-only policy. Say $10,000 of benefits. The cost will be relatively low and affordable.

This is an especially good approach for women. Because of breast cancer, the average age when women are diagnosed with cancer is younger than it is for men.

The planning strategy continues. With your cancer policy in place, buy a second policy that covers multiple critical illnesses.

You could wait until you are older, say your late 40s or early 50s. Heart attacks and strokes tend to happen at older ages.

Benefit 1: If you are diagnosed with cancer, you’ll be able to claim on both policies.

Benefit 2: You can always decide to drop the cancer only policy and just keep the comprehensive cii policy.

We believe insurance planning is important and can be confusing.

Here are two links to valuable information found on other American Associations websites.

Find the latest long-term care insurance statistics and facts reported by the American Association for Long-Term Care Insurance.

Read Medicare Supplement insurance facts and statistics reported by the American Association for Medicare Supplement Insurance.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.