New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Getting the best critical illness policy requires that you ask the right questions.

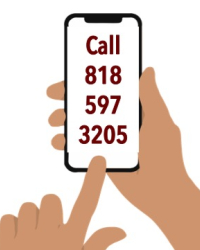

Call the American Association for Critical Illness Insurance at 818-597-3205.

We will help guide you with general information and answers to your questions.

If you want, we can connect you with an insurance agent who offers both cancer insurance and comprehensive critical illness insurance.

Or, we can suggest ways you can buy directly from an insurance company.

We are not here to preach. Those who choose to smoke or use tobacco products know the negative health consequences.

We are not here to preach. Those who choose to smoke or use tobacco products know the negative health consequences.

Insurance companies know that smokers have higher rates of cancer and heart disease. They factor that into their pricing.

Some policies offer ‘uni-tobacco’ pricing. That means that smokers pay the same as non-smokers. Better said, non-smokers are subsidizing some of their added risk.

IF YOU DO NOT SMOKE OR USE TOBACCO PRODUCTS your best price will likely be a policy that charges non-smokers LESS.

Cancer, heart attacks and strokes are all real risks. An no one can predict when (nor if) you’ll ever be impacted.

Cancer, heart attacks and strokes are all real risks. An no one can predict when (nor if) you’ll ever be impacted.

But, here’s what the data shows. Cancer generally happens at younger ages. Women get cancer earlier (breast cancer) than men. See cancer risk by ages.

Heart attacks and strokes generally happen at older ages, after age 65 or 70. See heart attack ages and data.

IF CANCER WORRIES YOU MORE you should look at one policy that gives you multiple options. Option One should be cancer-only protection. Option Two should be comprehensive critical illness insurance.

THE RIGHT CHOICE is getting coverage that gives you protection, peace of mind and is affordable. A cancer only insurance policy can cost significantly less.

Have critical illness insurance coverage. Get your money back IF you never use the policy. IT’S POSSIBLE.

Have critical illness insurance coverage. Get your money back IF you never use the policy. IT’S POSSIBLE.

Today, some critical illness policies include a special RETURN OF PREMIUM feature. Often this is an added option. But sometimes it can be included as part of the policy.

This feature is attractive to many consumers. After all, one of the things people hate about insurance is paying for something you might never use.

Of course, there is a cost for this feature. But, if it’s something that interests you, it’s worth asking about.

Find the best critical illness policy options. Call the Association at 818-597-3205. We can connect you with an agent knowledgeable in these policies.

All 50 states and the District of Columbia have laws that protect consumers buying insurance.

All 50 states and the District of Columbia have laws that protect consumers buying insurance.

The FREE LOOK PERIOD is a required period of time. During this time a new insurance policy owner can terminate the policy without penalties, such as surrender charges.

The free look period often lasts 10 or more days. It can vary.

During this time you have the right to cancel the policy and receive a full refund. If this provision is of interest to you, call the Association to connect with a knowledgeable insurance professional.

Take 60 seconds to use our Cost Calculator. See an example of costs for $10,000 of cancer only insurance.

The Association monitors the latest healthy news regarding cancer and heart disease prevention and treatments. We regularly post them on the Association’s Facebook page. You can access the page by clicking here.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.