New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

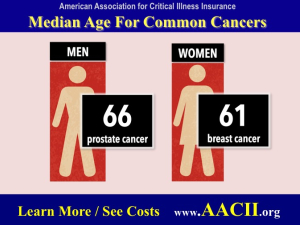

Women and men both face real risks like cancer, heart attack and stroke. Women tend to get cancer at younger ages. That’s because of breast cancer.

But while we show average age, that can be misleading. If the average age of women being diagnosed for cancer is 61, some are being diagnosed at 51. Others at 71.

We post many relevant critical illness statistics here. But they are only a guide. This is important coverage to get in your mid-to-late 30s. Definitely in your 40s and 50s. The risk of a critical illness striking between now and when you retire (or turn age 70) is high.

You can only get cancer insurance or critical illness insurance when you are in good health and can qualify.

Should I get this insurance? At least see what coverage costs!

Should I get this insurance? At least see what coverage costs!

Use the Cost Calculator on this webpage to see an instant estimate of what you might pay for $10,000 of cancer only coverage. You might be surprised at how affordable this important protection can be,

The Association recommends women consider an amount of coverage that is equal to your rent or mortgage payments for a period of between 6 and 18 months. Obviously, you can buy more coverage if you can afford it. But think of the peace of mind you’ll have knowing these expenses are covered for a year while you recover from your illness.

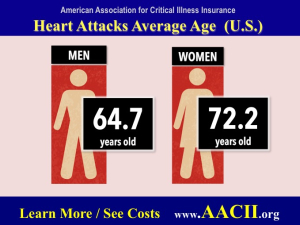

Cancer hits both men and women. So do heart attacks and strokes. But here’s some generalized information. Men get cancer at older ages than women. They get heart attacks at younger ages.

Cancer hits both men and women. So do heart attacks and strokes. But here’s some generalized information. Men get cancer at older ages than women. They get heart attacks at younger ages.

Maybe you can buy employer critical illness insurance. That’s great. But before you do, read our tips

Obviously men get cancer (prostate cancer in particular). They also get heart attacks and strokes.

Obviously men get cancer (prostate cancer in particular). They also get heart attacks and strokes.

So, yes, men should consider both cancer only insurance as well as critical illness insurance. Past generations of men were told to buy life insurance. But the chances of dying prior to age 70 are far lower than the risk of a critical illness. Planning today needs to be very different than it was in the past.

When you become eligible for Medicare, you will have options. There are Medicare Advantage plans. Also Medicare Supplement (or Medigap) plans. Finally there are Medicare Prescription Drug Plans.

When you become eligible for Medicare, you will have options. There are Medicare Advantage plans. Also Medicare Supplement (or Medigap) plans. Finally there are Medicare Prescription Drug Plans.

Find local Medicare insurance advisors near me. Use the directory provided free of charge by the American Association for Medicare Supplement Insurance.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.