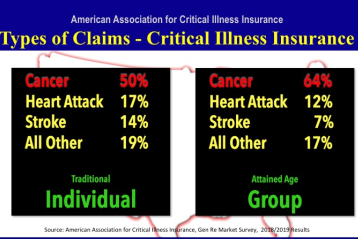

Cancer accounts for majority of critical illness insurance claims followed by heart attacks.*

“Cancer-only insurance policies tend to be significantly less costly.”

Jesse Slome, director of the American Association of Critical Illness Insurance

Type of claims include cancer, heart attacks and strokes

Critical illness insurance types of claims were reported today by the American Association for Critical Illness Insurance (AACII). Between half and nearly two thirds of claims were the result of a cancer diagnosis.

“This year 1.8 million Americans will hear the dreaded words you have cancer,” reports Jesse Slome, AACII’s director. “Fortunately the majority will be treated and survive. Unfortunately what may not survive is any savings, their home or other assets.”

According to Slome roughly 500,000 Americans will file for bankruptcy in a typical year. “The most common reason is health or medical conditions and surprisingly many of these good people had health insurance in place when the condition was first diagnosed.”).

Not all costs are covered by health insurance, Slome points out. “Many have high deductible plans, face co-insurance payments or will want out-of-network care, all of which has to be paid for,” he notes. “At the same time, most people will need to take time off from work to undergo treatments and recover.”

Consider coverage equal to between 6 and 18 months of rent payments

The Association is mounting a campaign to educate more individuals about the existence of cancer-only insurance as well as comprehensive critical illness insurance. “Both pay a lump-sum amount upon diagnosis of a covered condition like cancer,” Slome explains. “Cancer-only insurance policies tend to be significantly less costly.”

The critical illness insurance advocate recommends a simple way to estimate how much coverage to consider. “Calculate the cost of rent or mortgage payments for between six and 18 months,” Slome recommends. “Those tend to be the biggest expenses we all face. You’ll be able to focus on treatment and recovery and not have to worry about where you’ll be living.”

The latest types of claims data comes from the 2018/2019 U.S. Critical Illness Insurance Market Survey conducted by Gen Re.

Association director shares tips for critical illness insurance planning

First of all, the Association recommends all men and women over 40 read more about what is critical illness insurance?

Secondly, use the Association’s instant critical illness insurance cost calculator to see an instant estimate of costs.

Thirdly, cancer is a significant risk especially at younger ages. If you are in your 40s consider a cancer-only insurance policy. Because it will be more affordable, one may find it significantly of value.