One in eight women will be diagnosed during their lifetime but planning should really start in your 40s experts recommend.

“A woman age 45 may pay about $82-to-$90 a year for a cancer insurance policy providing a $10,000 cash benefit.”

Jesse Slome, director of the American Association of Critical Illness Insurance

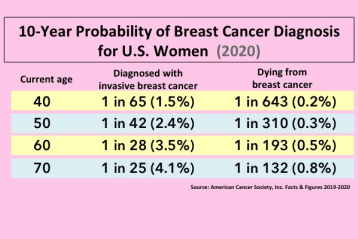

HEALTHY HABITS NEWS: Breast cancer probability for U.S. women; July 14, 2020. The latest information citing the 10-year probability of a breast cancer diagnosis was shared today.

“This year some 270,000 women will be diagnosed with breast cancer,” says Jesse Slome, director of the American Association for Critical Illness insurance. “Many reports will cite the median age but that could mislead many women into thinking their risk is well into the future.”

Breast cancer probability starting at age 40 shared

According to the most recent data researched by the organization that advocates for cancer and critical illness planning, a 40-year-old woman has a 1-in-65 chance of being diagnosed with breast cancer over her next 10 years. “A woman who is 50 now has a 1 in 28 chance of being diagnosed between now and when she turns 60. The likelihood grows from there,” Slome adds.

Lifetime risk is 1 in 8

Women face a huge risk of breast cancer and the consequences extend well beyond their health, Slome contends. One in eight women will be diagnosed with breast cancer according to the American Cancer Society.

“A breast cancer diagnosis is going to be rapidly followed by treatment and that will be costly,” Slome points out. “Even with health insurance the typical woman will face having to pay deductibles and co-insurance payments. That also assumes all costs and medications prescribed will be covered by insurance.” In addition, many women will take time off from work to undergo treatments and recovery. “The rent or mortgage and your cell phone bill don’t get postponed because you were diagnosed. That’s why pre-planning is so vitally important for women, especially those who are living on their own.”

Women should start planning in their 40s

The critical illness insurance expert recommends women start planning in their 40s. “Today, many insurance companies offer a cancer-only policy and that’s going to be more affordable than a comprehensive cii policy,” Slome explains. A woman age 45 may pay about $82-to-$90 a year for a cancer insurance policy providing a $10,000 cash benefit. “Insurers have the choice of charging non-smokers the same as smokers, even though their risk is higher,” Slome admits. The Association’s Cost Calculator shows a 45-year-old woman who uses tobacco products would pay $108 for a $10,000 benefit.

If your company offers employer critical illness insurance, read suggestions and tips for comparing shared by the Association. To learn more about how much critical illness insurance do I need, read the post.