New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

The Mutual of Omaha critical illness insurance product is a highly flexible product. It has some distinct advantages as well as some thing to consider.

The following provides generalized information. It is always advisable to speak with a licensed and knowledgeable insurance professional. He or she can give you the most current information and pricing.

Feel free to call the Association offices.

Feel free to call the Association offices.

Ask to speak with an insurance professional who can provide information regarding the Mutual of Omaha policy options as well as costs.

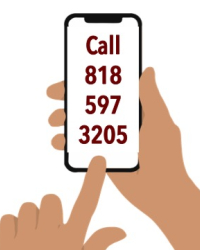

Call 818-597-3205 weekdays between 9AM and 3PM (Pacific time).

After hours you can send us an Email. Click here to Email us.

Mutual of Omaha calls their product, the Critical Advantage portfolio. It offers three options.

Critical Illness Insurance

Cancer Insurance

Heart Attack and Stroke Insurance

Coverage face amounts range from $10,000 to $100,000. The company offers ‘simplified underwriting’. That means fewer questions about existing health issues.

The Mutual of Omaha Critical Illness Insurance policy accepts applicants between ages 18 and 64. The Cancer and Heart Attack and Stroke policies accept applicants up to age 89.

Older Ages – Good or Bad? The Association’s position is that this coverage is most needed and valuable between ages 40 and 65.

Clearly the risk of cancer or a heart attack and stroke increases significantly after age 70. For that reason, this insurance gets quite costly after age 65 or 70. However, if you can afford it, definitely it is something to look into.

The Mutual of Omaha policy uses ‘uni-tobacco’ pricing. That means that smokers and non-smokers pay the same price for equal amounts of insurance.

Smokers and tobacco product users face a higher risk of getting cancer. They also face higher risks for having heart attacks or strokes.

For smokers or tobacco users, this policy may offer some significant cost savings. That is compared to insurance companies that charge more to those who smoke.

For that reason, it is definitely worth a quick call to find pricing for the Mutual of Omaha cancer or critical illness policy.

Insurance companies have two options when it comes to pricing cancer or critical illness insurance pricing. They can charge women and men the same. This is referred to as ‘uni sex’ pricing. It makes things easy.

So what is the disadvantage. Women and men have different risks that vary by age. One example is cancer. Women face a greater risk of cancer at younger ages. That’s because they risk breast cancer.

The price difference may be very little. Or, it may be quite a bit. Is it worth comparing? In the Association’s option, it is always worth comparing. You want the best coverage for the best price.

Read our tips on ways to save on critical illness insurance.

If you are being offered group critical illness insurance at work, here’s some tips for comparing.

Finally the Association has an excellent Facebook page. We post briefs on the latest health news, scientific findings related to reducing your risk of cancer and heart disease. Click this link to access the Association’s Facebook page.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.