New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

It’s paid directly to you.

It’s paid directly to you.

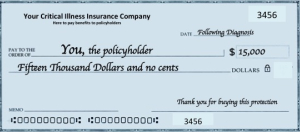

Critical illness insurance pays you directly in a lump-sum cash (check) payment.

No deductible.

Zero receipts needed for reimbursement.

The insurance company mails your check right after your claim is verified.

You choose how to spend the money.

You choose how to spend the money.

Use the money however you want. Cover medical costs NOT paid by your insurance (deductibles and co-pays). Use funds to pay for travel for treatments or second opinions.

Many people use the money to pay their rent or mortgage payments while they take time off from work for treatments or recovery.

Payments will be paid directly to you, not to the doctors, hospitals or other health care providers. You will receive a check, payable to you, for maximum convenience.

Yes. Your insurance company will specify what they need to process your claim. Most will have a way to file your claim online.

Yes. Your insurance company will specify what they need to process your claim. Most will have a way to file your claim online.

Once all required information is received, claims are generally processed within 10 business days.

Expect the insurance company to require 2 or 3 pieces of information. They’ll include an Authorization to Disclose Information and information from your doctor.

The Association recommends the following simple formula. Calculate the cost of rent or mortgage payments for 6 months and 18 months.

The Association recommends the following simple formula. Calculate the cost of rent or mortgage payments for 6 months and 18 months.

Most people actually buy between $10,000 and $15,000. And, the average critical illness insurance claim payment is between $12,000 and $15,000.

If you can afford more, buy more. But, our thinking is that treatment and recovery usually is a matter of months (not years). You want the peace of mind that major bills are covered while you take time off from work. And, if you are married, you can bet that your spouse or partner will take time off to be with you.

Take a vacation with your spouse or loved ones. We are serious! No one wants to ever get sick, much less be diagnosed with cancer, have a heart attack or stroke.

Take a vacation with your spouse or loved ones. We are serious! No one wants to ever get sick, much less be diagnosed with cancer, have a heart attack or stroke.

The good news is that chances are you will survive. You’ll use the critical illness insurance to pay for costs.

If there’s any left over, YES, use it to take a well deserved and needed vacation. You aren’t the only one who needs it. Your spouse and family do as well.

Did having critical illness insurance work for you?

Did having critical illness insurance work for you?

What was the benefit of having cancer insurance coverage?

We’d welcome a brief email sharing your story. It will help us educate other people to the important benefits of this coverage.

Write to Jesse Slome, Association Director. Email me at jslome (AT @) criticalillnessinsuranceinfo.org. Thank you.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.