Critical Illness Insurance Calculator

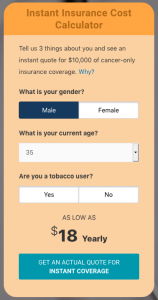

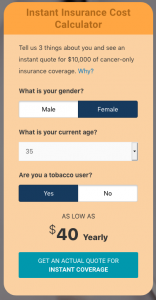

Use the Cost Calculator on this webpage to get an instant cost for $10,000 of cancer-only coverage.

The pricing shown is based on the policy offered by Unified Life Insurance Company. This policy is exclusively offered via the Association’s website.

CRITICAL ILLNESS INSURANCE PRICING

The Cost Calculator shows pricing for cancer-only insurance. Below, we give some examples that will help you estimate costs for a comprehensive ci insurance policy.

Take the 10-second critical illness insurance SAVINGS CHALLENGE

Get an immediate estimate of costs for $10,000 of cancer-only insurance.

Get an immediate estimate of costs for $10,000 of cancer-only insurance.

The calculator starts off blank.

Start by clicking your gender. You will instantly see a rate appear.

The Cost Calculator is private. No personal information is needed. No cookies are planted.

The calculator shows rates for cancer only coverage. The chart below gives you a quick way to estimate what a comprehensive critical illness insurance policy will cost. It will be about 2-to-4 times more.

What's a quick way to estimate critical illness insurance costs?

| Cancer Only | Critical Illness Insurance | |

|---|---|---|

| Male age 45, Non-Smoker, $15,000 Benefit | $71.10-per-YEAR | $237.15-per-YEAR - or about 3.3 times more |

| Female age 45, Non-Smoker, $15,000 Benefit | $122.25-per-YEAR | $229.50-per-YEAR - or about 1.8 times more |

| Male age 45, Smoker, $15,000 Benefit | $121.05-per-YEAR | $421.50-per-YEAR - or about 3.5 times more |

The rates above are approximations derived by the Association and are provided merely to serve as an example of what a consumer might find. Request real rates from your agent or employer-provided plan.

Our calculator shows different rates for men and women. Why?

Critical illness insurance companies have two pricing options.

Critical illness insurance companies have two pricing options.

They can charge men and women who are the same age the same price. That is called ‘unisex’ pricing.

Or they can charge men and women based on their specific risk. That’s called ‘sex distinct’ pricing.

Which is better? It depends and that’s a reason to compare. For example, women in their 40s generally face a higher risk of cancer within the next 10 years. Breast cancer is the reason. So, women in their 40s may pay more than men.

Likewise, men in their 50s face a higher risk of having a heart attack or stroke within the next 10 years. So, they will likely pay more for critical illness insurance.

Our calculator shows different rates for tobacco users. Why?

This one should be pretty obvious. Tobacco users face a higher risk of cancer, They also face a higher risk of heart disease and strokes.

This one should be pretty obvious. Tobacco users face a higher risk of cancer, They also face a higher risk of heart disease and strokes.

Insurance companies again have a choice. They can charge both the same. When they do it means that smokers are being subsidized by non-smokers.

Non-smokers should definitely compare rates from companies that offer both options. The savings could be significant.

A WARNING TO TOBACCO USERS. Making a false statement on an insurance application can void your policy when you apply for claim benefits. Don’t do it. You likely will be found out and risk getting the benefit when you need it the most.

Check out an instant critical illness insurance cost from a top company

Get instant cost quotes direct from one the the top companies. Compare rates for BOTH the exclusive cancer-only and the comprehensive critical illness insurance.

Get instant cost quotes direct from one the the top companies. Compare rates for BOTH the exclusive cancer-only and the comprehensive critical illness insurance.

What other pages offer savings and other tips?

Read tips that will help you compare critical illness insurance policies.

Find tips to help you get the best critical illness insurance quotes.

Learn more about the top critical illness insurance companies.

May we also recommend our sister industry trade organizations

Equally important for adults 50 or older is learning about long-term care planning. Visit the American Association for Long-Term Care Insurance website. You will learn more about this important topic and be able to connect with local long-term care insurance professionals.

Likewise if you are turning 65 visit the American Association for Medicare Supplement Insurance. We make available the nation’s only national Find A Local Medicare Agent online directory.

Additional Tips for Consumers:

Firstly, your contract defines what is covered and what is not. Verbal representations by agents or others are not binding.

Secondly, it is really important to think how many years you want this coverage to last. For many, their critical illness insurance protection is most important until they retire (at age 65 or 70). After that you will have Medicare and Social Security. You home may be fully paid off.

Thirdly. it often pays to buy this coverage 30-to-60 days before your next birthday. You may lock in lower rates.

Fourthly, for many people in their 40s and 50s. the chance you’ll use a critical illness insurance policy is higher than the chance you’ll use a disability insurance or life insurance policy. We have some good information on this website.

Finally, only buy what you know you can afford not just now but for the next few years. Too many people buy this coverage. Then they have buyers remorse and don’t pay for year two. When you do that, it may benefit the insurance agent but not you.

Regardless of what you decide, we thank you for taking the time to visit the Association’s website.

New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better heart health in midlife lowers late-life dementia risk

Better cardiovascular health in midlife can reduce dementia risk later in life.

Insomnia heart disease; 42% reduction in heart failure

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

Instant Insurance Cost Calculator

An Exclusive Offer

Highly affordable cancer or critical illness insurance

from Unified Life Insurance Company

- Lump sum immediate cash benefits: $10,000 to $25,000

- Ages 30 to 55

- Rates starting as low as $3.25 per month