Top Companies Offering Critical Illness Insurance

Ten top insurance companies offering critical illness insurance are:

- Aetna

- Aflac

- Allstate

- Assurity

- Bankers Life

- Liberty Bankers

- MetLife

- Mutual of Omaha

- Unum

- Unified Life

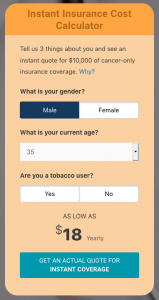

Take the 30-second critical illness insurance SAVINGS CHALLENGE

Get an immediate estimate of costs for $10,000 of cancer-only insurance. Use the Instant Cost Calculator on this website to see instant rates. Rates are approximately based on the exclusive product offered.

Get an immediate estimate of costs for $10,000 of cancer-only insurance. Use the Instant Cost Calculator on this website to see instant rates. Rates are approximately based on the exclusive product offered.

The Cost Calculator is private. No personal information is needed. Click just one box (example Male) and you will instantly see the rate appear.

Rate will change based on your sex and use of tobacco products.

Comprehensive critical illness insurance coverage will cost more. That’s because these policies pay benefits for multiple conditions.

Check out critical illness insurance costs directly from an insurer

Get instant cost quotes direct from one the the top companies. Compare rates for BOTH the exclusive cancer-only and the comprehensive critical illness insurance.

Get instant cost quotes direct from one the the top companies. Compare rates for BOTH the exclusive cancer-only and the comprehensive critical illness insurance.

Click the GET YOUR FREE QUOTE box that’s part of the advertisement on this webpage.

A word about comparisons for top companies

There are roughly 60 insurance companies that offer some form of cancer-only or comprehensive critical illness insurance. Products continually change. Pricing also changes and can vary by state.

Accordingly consumers must compare what is currently approved for their state. Specifically, request and read all information provided. Verbal representations are not binding.

Finally, keep copies of all documents in a secure place where they can be accessed by others. This is important because you want them easily found should someone need to start a claim on your behalf.

Aetna Critical Illness Insurance

The Protection Series from Continental Life Insurance, an Aetna Company, offers both cancer and critical illness options. The cancer insurance offers benefit amounts from $5,000 to $75,000. The base policy pays one time for a cancer diagnosis. An option provides additional payments in case the cancer returns. The Aetna comprehensive critical illness insurance policy also pays benefits starting at $5,000 to $75,000.

The Protection Series from Continental Life Insurance, an Aetna Company, offers both cancer and critical illness options. The cancer insurance offers benefit amounts from $5,000 to $75,000. The base policy pays one time for a cancer diagnosis. An option provides additional payments in case the cancer returns. The Aetna comprehensive critical illness insurance policy also pays benefits starting at $5,000 to $75,000.

Issue ages: 18-89

Rates: It pays to compare Aetna with other critical illness insurance plans. Likely you will find less costly coverage at some levels.

30 day waiting period. Eligibility for benefits begins 30 days after the coverage effective date.

Aflac Critical Illness Insurance

Information coming

Assurity Critical Illness Insurance

Assurity Life Insurance company offers a critical illness insurance policy.

Policies are sold on both an individual basis by insurance agents. The company also offers policies through the worksite setting.

Sample rates for $10,000 – individual critical illness insurance policy:

Male, Age 48 (Non-nicotine): $235.59-per-year

Female, Age 48 (Smoker): $298.65-per-year

Liberty Bankers Life Critical Illness Insurance

Liberty Bankers Life Insurance company offers a critical illness insurance policy.

Liberty Bankers Life Insurance company offers a critical illness insurance policy.

Policies are priced in units. Units start at $5,000. Coverage up to $100,000 is available.

Sample rates for $10,000 – individual critical illness insurance policy:

Male or Female, Age 48: $42.20-per-month ($506.40-per-year)

Family, Both spouses are age 48: $75.08-per-month ($900.96-per-year).

LifeSecure Critical Illness Insurance

Lifesecure offers a worksite critical illness insurance product with issue ages from 18-70 (18-64 in California).). There is no medical underwriting for $10,000 of coverage. Amounts of $20,000 may be available with simplified underwriting.

Lifesecure offers a worksite critical illness insurance product with issue ages from 18-70 (18-64 in California).). There is no medical underwriting for $10,000 of coverage. Amounts of $20,000 may be available with simplified underwriting.

Sample rates for $20,000:

Age 42 (Non-nicotine): Self-Only $28.55-per month. With Spouse: $39.95-per-month.

Age 42 (Nicotine use): Self-only: $44.75-per-month. With Spouse: $65.15-per-month.

Mutual of Omaha Critical Illness Insurance

The Mutual of Omaha Critical Advantage Portfolio offers three products. They include cancer insurance, critical illness insurance and heart attack/stroke insurance.

The Mutual of Omaha Critical Advantage Portfolio offers three products. They include cancer insurance, critical illness insurance and heart attack/stroke insurance.

Face amounts range from $10,000 to $100,000.

Sample rates for $10,000. Cancer-only policy

Male, age 45 non-smoker: $121.90

Male, age 45, smoker: $121.90

Sometimes men pay less. Sometimes women pay less

It’s true. What it means is the insurers have really based their prices on what they see as the real risks.

The exclusive product we keep referring to charges different rates for men and women. At some ages men will pay less. At other ages women will pay less.

Yes, that’s one more reason we recommend getting that Free Quote now.

Example: $10,000 of Cancer-Only insurance cost?

MALE age 47, No-tobacco: $50-per-year

FEMALE age 47, No-tobacco: $85-per-year

MALE age 47, Tobacco use: $82-per-year

FEMALE age 47, Tobacco use: $110-per-year

Note, the policy may have some minimum amounts at certain ages. For example, a male non-smoker at age 47 might need to start with $15,000 or cancer-only coverage.

Numbers shown are merely examples created by the Association to depict what a consumer may find in the marketplace.

What would $10,000 of Critical Illness Insurance cost?

MALE age 47, No-tobacco: $160-per-year

FEMALE age 47, No-tobacco: $150-per-year

MALE age 47, Tobacco use: $286-per-year

FEMALE age 47, Tobacco use: $215-per-year

Compare if Your Employer Is Offering Critical Illness Insurance

If your Employer offers critical illness insurance here are things to compare:

- Do you have both cancer-only and comprehensive critical illness options?

- Compare the annual rate.

- Can you pay monthly? Is there an added charge?

- Are there any additional fees?

- Do non-smokers pay the same as smokers?

- Do men and women pay the same (for the same age)?

- Are premiums level or will they increase as you age?

- If you leave the company, can you continue the coverage?

- Does the policy terminate at a certain age?

- Can my spouse or partner be covered by the same company?

Additional Critical Illness Insurance Information is available. Besides information here, access the Critical Illness Insurance Association’s News Archive to read the latest information on cancer, heart attacks, strokes and critical illness insurance.

Specifically, see the latest Facts About Cancer from the American Cancer Society.

Then see the latest Heart Disease Prevention Tips from the American Heart Association.

Compare Aetna, Unum, AFLAC and other critical illness insurance policies

Read more about getting the best critical illness insurance quotes.

Additional Tips for Consumers:

Firstly, your contract defines what is covered and what is not. Verbal representations by agents or others are not binding.

Secondly, it is really important to think how many years you want this coverage to last. For many, their critical illness insurance protection is most important until they retire (at age 65 or 70). After that you will have Medicare and Social Security. You home may be fully paid off.

Thirdly. it often pays to buy this coverage 30-to-60 days before your next birthday. You may lock in lower rates.

Fourthly, for many people in their 40s and 50s. the chance you’ll use a critical illness insurance policy is higher than the chance you’ll use a disability insurance or life insurance policy. We have some good information on this website.

Finally, only buy what you know you can afford not just now but for the next few years. Too many people buy this coverage. Then they have buyers remorse and don’t pay for year two. When you do that, it may benefit the insurance agent but not you.

Regardless of what you decide, we thank you for taking the time to visit the Association’s website.

New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better heart health in midlife lowers late-life dementia risk

Better cardiovascular health in midlife can reduce dementia risk later in life.

Insomnia heart disease; 42% reduction in heart failure

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

Instant Insurance Cost Calculator

An Exclusive Offer

Highly affordable cancer or critical illness insurance

from Unified Life Insurance Company

- Lump sum immediate cash benefits: $10,000 to $25,000

- Ages 30 to 55

- Rates starting as low as $3.25 per month