New drug inhibits cancer cell growth

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

High deductible health plans were created to benefit working individuals and families. Unfortunately for most it hasn’t worked as intended.

And, for many Americans between ages 40 and 65, the Post-Covid economy is likely to make things even worse. This is one important reason to consider learning more about critical illness insurance.

High deductible health plans (HDHPs) were introduced in 2004. The idea was a plan that reduced the cost for health insurance coverage.

HDHPs would especially benefit the millions of workers offered health plan coverage at work. The plans would especially benefit younger individuals who generally have few if any health-related costs.

To sweeten the deal, the government approved tax-advantaged Health Savings Accounts (HSAs). Individuals would contribute dollars into their individual HSA on a pre-tax basis. When withdrawn for medical expenses the money would not be taxed.

So what’s the problem? And why will a post-Covid economy likely make the situation worse for many working age Americans?

Since their introduction, high deductible health plans have increased dramatically in acceptance. Among adults between ages 16 and 64 who have employment-based health coverage the percentage enrolled in a traditional health plan decreased from 85% to 57% according to the U.S. Department of Health and Human Services. Meanwhile some 19% have an HDHP coupled with an HSA. One in four (24.5%) have a High Deductible Plan without the tax-advantaged savings benefit of an HSA.

Without question, those with no or few medical issues during each year benefit from the money saved by selecting a high deductible plan.

Those who have more serious or frequent medical needs are at risk when they have a high deductible plan.

Those who have more serious or frequent medical needs are at risk when they have a high deductible plan.

Many of us are one diagnosis away from a most significant financial crisis. Consider that one American adult is diagnosed with cancer every 21 seconds and another has a heart attack every 40 seconds. Add to that accidents, pregnancies, diabetes and now, of course, the Covid virus.

You are likely to be impacted in three ways when you experience any serious health issue.

First, you are likely to reach your health plan deductible.

Second, you will likely face meeting out-of-pocket maximums.

Thirdly, you are likely to find not all health related costs (including the medications prescribed) are going to be covered by your insurance plan.

Finally, you’ll need time off for treatments and recovery. Time off equals less income to pay your rent, mortgage, child care, cell phone bills.

And, if all this wasn’t enough, here’s a face you don’t think about. You will still be paying your monthly health insurance premium whether you are working or in the hospital.

Following difficult financial times personal bankruptcies skyrocket.

Following difficult financial times personal bankruptcies skyrocket.

In 2006, 597,965 Americans filed for personal bankruptcy.

By 2010, the number soared to over 1.5 million.

A Harvard University study found that two thirds of bankruptcies were linked to medical and health-related bills.

Most of those filing for bankruptcy were middle class and had health insurance.

Hospital bills were the largest single expense for about half of all medically bankrupt families; prescription drugs were the largest expense for 18.6 percent.

For individuals covered under a HSA-Qualified HDHP plan the ‘average’ annual deductible is $2,476 for single coverage and $4,673 for family coverage.

The ‘average’ out-of-pocket maximum is $4,492-per covered plan participant.

The word average is placed in quotes because the IRS defines a high deductible health plan as any plan where the total yearly out-of-pocket expenses (including deductibles, co-payments, and coinsurance) can’t be more than $6,900 for an individual or $13,800 for a family.

The plan would work when individuals contribute at least an amount equal to their exposed risk into their Health Savings Plan. Unfortunately, that’s not the case.

While maximum HSA contribution amounts for 2020 are $3,550 for self-only and $7,100 for families. Few contribute the maximum.

For those with accounts open for one year, the average individual HSA contribution was $1,166, according to Employee Benefits Research Institute.

In 2018, the average HSA balance was $2,803.

One major illness and your HSA will be wiped out just covering the deductible. Forget about co-payments and all the other financial bills you’ll face.

You are one diagnosis away from crisis. Perhaps even being forced to file for bankruptcy.

An alternative way to plan is warranted. Critical illness insurance provides a lump-sum cash benefit you can use as you need. Pay your medical bills. Your rent or mortgage. Child care … whatever you need to get you back up and running.

Today, the better critical illness insurance plans offer both a cancer-only as well as a comprehensive critical illness insurance coverage. The latter pays a lump-sum cash benefit not just for a cancer diagnosis but for conditions like heart attack, stroke and organ transplants.

For a 45-year old male who doesn’t use tobacco products, a $10,000 cancer-only benefit will cost around $50-to-$60 yearly.

Women tend to pay more (around $85-per-year) because of the heightened risk of breast cancer at younger ages.

Most critical illness insurance purchases tend to be modest. In 2020, AACII reported that the average of critical illness insurance policies purchased through employers ranged from $12,961 to $15,408.

You can always argue in favor of more insurance, but this modest approach to planning is both affordable and sound.

We believe some coverage is always better than no coverage. In your 40s and 50s the Association suggests pricing both a cancer-only as well as a full ci insurance policy. The better companies today offer you both options within one policy.

Our suggested formula is coverage equal to between six (6) and 18 months of your rent or mortgage payments. That should be more than enough to cover your bills.

And, if any money is left over, you can use it to take that well deserved trip or family vacation.

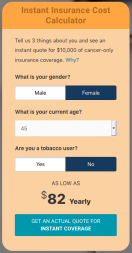

SEE WHAT $10,000 of cancer insurance might cost. Use the Association’s Cost Calculator.

SEE WHAT $10,000 of cancer insurance might cost. Use the Association’s Cost Calculator.

If your company offers employer critical illness insurance, read our suggestions for comparing coverage and getting the best value and options.

Finally we post ways consumers can compare critical illness insurance policies to find the best rates and options.

A new compound starves the growth of cancer cells. Future anti-tumor drug for the future likely.

Better cardiovascular health in midlife can reduce dementia risk later in life.

Adults with the healthiest sleep patterns had a 42 percent lower risk of heart failure.

The Association advocates for the importance of planning and supports insurance professionals who market critical illness and cancer insurance.

Thank you for your interested in critical illness insurance. You are about to leave our site and be redirected to Unified Life Insurance Company’s website where you can learn more and apply online.

Your age, sex and use of tobacco helps to determine your estimated rate for this insurance coverage. We want to provide as accurate a number as possible.