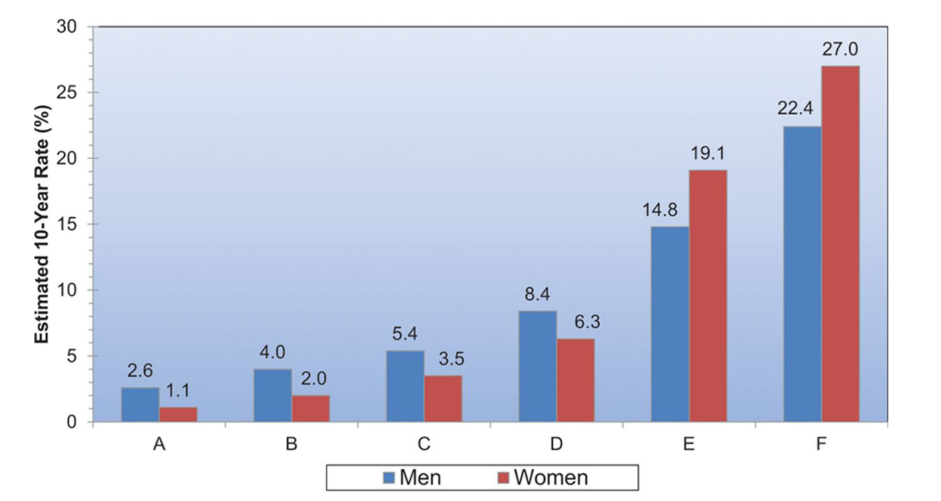

Risk factors for men and women at age 55. Key factors that increase stroke risk to 27%.*

A stroke is one of the three primary health issues covered under critical illness insurance. If you don’t plan before age 55 you may not be able to obtain this important protection.

Jesse Slome, director of the American Association of Critical Illness Insurance

Strokes and Critical Illness Insurance

Americans face a huge stroke risk. Significantly, every 40 seconds, someone in the United States has a stroke. A study from the American Heart Association shows the 10-year risk for men and women at age 55. It weights risk factors including blood pressure, diabetes and cigarette smoking.

“You are highly likely to survive a stroke” explains Jesse Slome. Slome is director of the American Association for Critical Illness Insurance (AACII). “But many survivors are not prepared for costs associated with surviving a stroke. Accordingly the study helps show who is at greater risk.”

Women who smoke, have diabetes and high blood pressure face the greatest risk (27.0 percent). Those women who do not smoke, have good blood pressure numbers and no diabetes face the lowest risk (1.1 percent). Undoubtedly the data is helpful. However numbers can’t predict your individual real risk, Slome adds. Therefore it’s important for all to think about their future.

Stroke is one of the three primary health issues covered under a critical illness insurance policy. “If you don’t plan before age 55 you may not be able to obtain this important protection,” Slome explains. Following a health incident, obtaining insurance protection is unlikely. Earlier planning is essential, the expert points out. Before turning 50 is ideal for critical illness insurance.

Estimated 10-Year Stroke Risk in adults age 55

| A | B | C | D | E | F | |

| Blood Pressure | 95-105 | 138-148 | 138-148 | 138-148 | 138-148 | 138-148 |

| Diabetes | No | No | Yes | Yes | Yes | Yes |

| Cigarette Smoking | No | No | No | Yes | Yes | Yes |

Chart and data from American Heart Association, Circulation, Volume 131(4):e29-e322, January 27, 2015

“Chiefly, start learning about critical illness insurance in your 40s,” Slome advocates. “Consider coverage equal to the cost of between 6 and 18 months of rent or mortgage payments,” he suggests. “Undoubtedly this benefit will give you time to recover while this major expense as well as others covered.”

Tips for critical illness insurance planning

First of all, the Association recommends all men and women over 40 read more about what is critical illness insurance?

Secondly, use the Association’s instant critical illness insurance cost calculator to see an instant estimate of costs.

Thirdly, stroke is only one health risk. Indeed cancer is a significant risk especially at ages prior to 70.

Fourthly, read tips to better compare critical illness insurance coverage. Significantly there are differences between policies. Therefore the helpful tips can save you money.